value appeal property tax services

3973300 Revised Assessed Value. The tax rates are set by individual.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

If you feel like your tax payments have become too much to bear DoNotPay can help you understand how to lower them in a blink of an eye.

. Hopefully you will find the information you are seeking about Reasons To Appeal Property Taxes. Comprehensive property tax protest representation and advisory service for individual and institutional investors in Texas. ValueAppeal shuts down property tax appeal service changes focus to MoneyBall for real estate agents by John Cook on October 15 2013 at 932 am October 15 2013 at 949.

This fee shall be owed if there is a reduction to the propertys 2022 assessed value and associated property taxes which comes as a result of our efforts. Our property tax appeal services can help return significant property tax dollars to you. Following is a table click on link for Chapter 123 Table you can use to determine your estimated market value and the Common Level Range for your property examples are for illustrative.

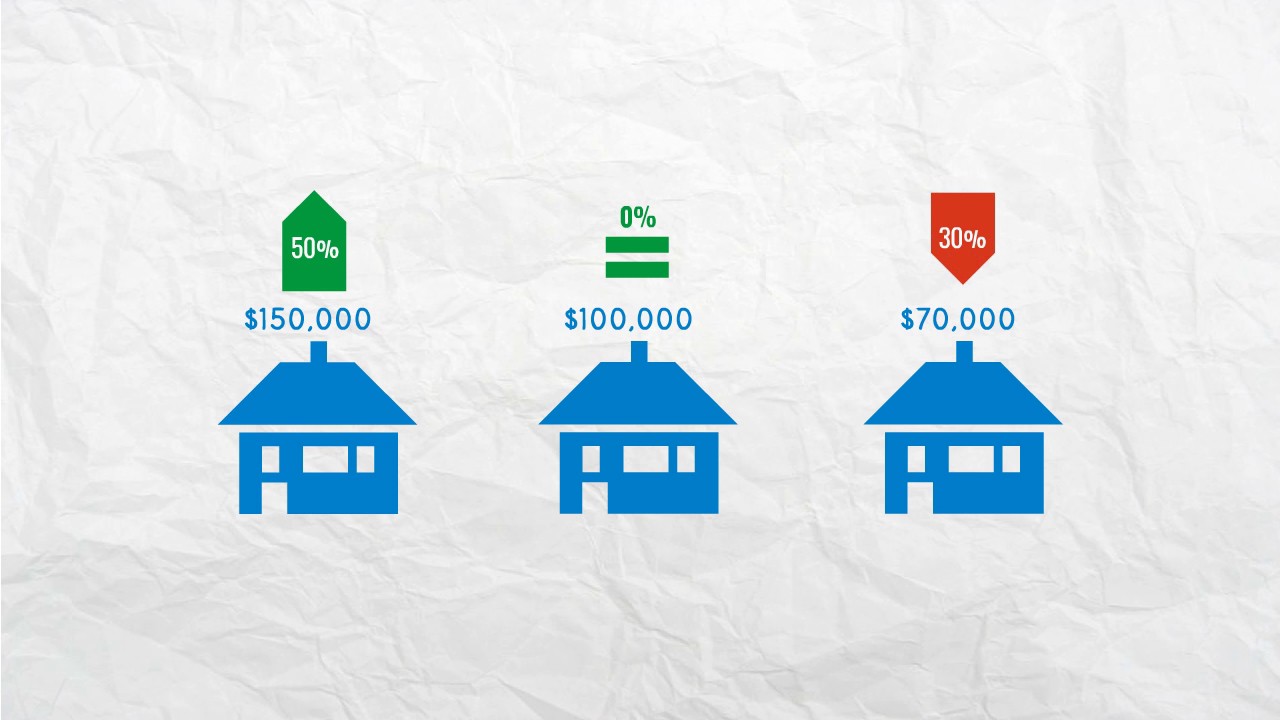

One way to lower your property tax is to show that your home is worth less than its assessed value. CBRE offers a full spectrum of Property Tax Services including assessment and appeal services budget accruals and pre-acquisition due diligence and consulting. We monitor your property values applying our knowledge of.

The professionals at Property Tax. In addition to our appeals service we provide personal property form filing and property tax management services. Our Full-Service Property Tax Appeal Process If you disagree with your property assessment 7047 grants you the right to appeal.

If you wish to make an appeal to the County Board please contact countyvalueappealhennepinus or 612-348-7050 by May 18 2022 to request an appointment. There are various online property value estimators. NJ Property Tax Appeal 28 Kenneth Place Clark NJ 07066 Tel.

If you feel the appraised value of your property is too high you have the right to appeal your property value and possibly lower your property taxes. The Trouble With Property Taxes in the US. At Fair Assessments we have the knowledge experience and resources to.

Zillow is one of the various options that you can use for getting an online value estimate. That assessed value is whats used to calculate how much tax you owe. If you have value questions you may call 503 846-8826.

Appealing to the State Board of Equalization. There is an appeal process to assist property owners in presenting their concerns about property valuation. This is where property tax appeal services can come in handy.

Texas Property Tax Appeals Steps to Protesting and Reducing Your Property Value Annually. Appeals of Property Assessment. The Property Tax Appeal Process Explained.

Thats up to local taxing units which use tax revenue to. Real estate value appeals may be filed. 8179000 Original Assessed Value.

With limited exception a disputed assessment must first be appealed to the county board of equalization of where the property is located or it. Depending on when a property is reappraised it can cause a commercial property tax value to increase. We save property owners time and money appealing.

Property taxes pay for public needs and services such as schools hospitals general funds roads and other utilities. File a Protest Texas property tax appeals can be filed using the form provided by the. The Comptrollers office does not collect property tax or set tax rates.

Although sources like these can definitely help. Our proprietary systems design enables us to capture the entire property tax process as well as provide administrative support for our clients. They can help you assess the true value of your home and file an appeal to reduce your property taxes.

Challenging the property assessments can be a time. Appeal involving medical office building with 3 parcels functioning as one economic unit. You may obtain petition forms by calling 503 846-3854 or go to our Board of Property Tax Appeals BoPTA website.

The appeal deadline is fast approaching. OConnor is the largest property tax consulting firm in the US. Texas has no state property tax.

Here at Tax Appeal Consultants. Its possible to trim your property tax bill by appealing the value the taxman assigned to your home. Fair Assessments may lower your residential property taxes by reducing and capping tax assessments.

TAX APPEAL CONSULTANTS provides no stress property tax appeal services for all types of real property throughout Southern California. Our licensed tax consultants and administrative support team benefits home and property owners by reducing property tax. How property taxes work.

If not we are happy to answer your email or phone questions.

How To Know When To Appeal Your Property Tax Assessment Bankrate

How To Appeal Your Cook County Property Taxes The Details Income Tax Tax Attorney Property Tax

Best Tips For Lowering Your Property Tax Bill Property Tax Real Estate Advice Real Estate Articles

This Tax Season May Be Over But What Should You Be Doing Now For The Next Llc Taxes Tax Deductions Property Tax

You Can File A Propertytaxappeal If You Think The Rate Is Too High You Will Probably Not Want To Do All The Paperwork Yourself And Property Tax Tax Graphing

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Property Valuation Services Corporation Property Assessment In Nova Scotia Property Valuation Services Corporation

Property Valuation Services Corporation Appeal Process

Property Tax Appeal Appeal Property Tax Property Tax Appeal Houston Property Tax Appeal Texas Property Tax Appealing Tax

Property Tax Appeals Process Property Tax Tax Estate Tax

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Best Tips For Lowering Your Property Tax Bill Tax Refund Tax Time Tax Lawyer

Frequently Asked Questions Faqs Property Assessment Appeal Board

Four Important Key Points To Lower Hotel Property Taxes In 2021 Property Tax Property Values Commercial Property

Best Tips For Lowering Your Property Tax Bill Property Tax Real Estate Articles Mortgage Savings

My Services Home Buying Can Be A Tricky Process Let Me Make Your Life Easier And Help You Fi Home Buying Process Home Buying Honesty And Integrity

Property Tax Appeals When How Why To Submit Plus A Sample Letter